Chips Caught in the U.S.-China Crossfire: Survival Guide for Tech Investors

The semiconductor sector was rocked this week by reports that the Biden administration is considering a sweeping crackdown on exports of chipmaking equipment to China. Stocks like ASML, Nvidia, TSMC, and Tokyo Electron fell sharply as investors grappled with the implications of a potential disruption to global chip supply chains.

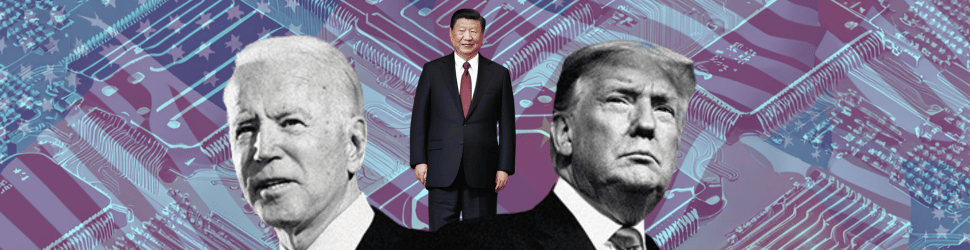

The news highlighted the rising geopolitical risks that chip investors must navigate as tensions between the U.S. and China escalate. Former President Donald Trump further stoked those concerns by claiming Taiwan took "100%" of America's semiconductor business and suggesting the island should pay for its own defense.

While the saber-rattling grabbed headlines, it reflects a harsh reality - the world's most cutting-edge chip production is increasingly caught in the crossfire of a brewing technological Cold War between superpowers.

For companies at the forefront of semiconductor manufacturing, the threats and uncertainties are all too real. Fallout from tighter export controls or Chinese retaliation against U.S. partners could upend business models and dramatically impact future growth prospects.

Sponsor Ad

Nvidia's NEW "Silent Partners"

Many companies partnering with Nvidia have seen their own stocks go up …

That includes ASML, up as much as 471% …

Super Micro Computer, which has surged as much as 3,244%.

And Taiwan Semiconductor, which has soared as much as 4,744%.

With Nvidia now pivoting to a new $1 trillion AI superproject …

A new set of partners appear to be poised to benefit.

Find out who they are right away.

ASML, the Dutch maker of vital chipmaking equipment, arguably has the most exposure with nearly half its sales coming from China last quarter. A substantial slice of future revenue is at stake if tensions fully boil over and it loses access to the Chinese market.

"What we are seeing play out is the fragmentation and political splintering of semiconductor supply chains that had previously been highly globalized and interdependent," said Brock Yordy, analyst at Bernstein Research. "This is a significant risk if it continues to accelerate."

Investors may need to start bracing for a decoupling – where Chinese and Western semiconductor ecosystems start breaking apart into separate spheres. That could require companies to duplicate investments and infrastructure to maintain operations in both realms.

For major Asian chipmakers like TSMC and Samsung, which have large footprints and plants in China, it exacerbates supply chain headaches. Do they absorb higher costs to shift output away from China? Or do they risk getting caught in the political crosshairs with U.S. export bans?

"These companies are essentially stuck in the middle, forced to weigh which global power they want to preserve business with more," said Dan Hutcheson, CEO of Tech Insights.

While the Trump comments may seem bombastic, they are a stark reminder of how quickly the political landscape could shift if he regains the presidency in 2024. That adds another layer of risk around the long-term policy uncertainty that chip companies must account for.

Sponsor Ad

China's Sneak Attack on the U.S. Dollar

Full Story >>

The semiconductor industry was already bracing for a cyclical downturn in demand amid a shaky economy. Now it faces the added complexity of navigating a rapidly shifting geopolitical environment that threatens to splinter the global supply chain.

For investors in these stocks, paying close attention to their China exposure, contingency planning, and efforts to maintain optionality in both markets will be crucial to navigating the crosscurrents ahead. In this climate, boring may be better – favoring diversified chipmakers with stronger domestic operations over those heavily leveraged to the Chinese market.

In an increasingly bipolar chip world, preserving flexibility while limiting geographic concentration risk may be the path to safer returns until the geopolitical landscape becomes clearer.